Author: Keith Mabe

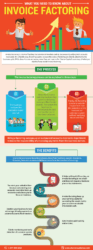

How to Choose an Invoice Factoring Company

Common Invoice Factoring Mistakes to Avoid

Fixing the Problems Facing Small Business is Good Business

Industries That Can Utilize Invoice Factoring

What is Invoice Factoring? Invoice factoring, also known as accounts receivable factoring, is a convenient alternative to a traditional bank loan. Where bank lending requires a long-term contract, invoice factoring services give you almost immediate cash, when you need it without any long-term financial obligations….