Take your business to the next level with accounts receivable factoring for Services Companies.

We offer factoring services for start-ups and well-established service providers to help them manage their cash flow and cover essential expenses.

Invoice Factoring for Service Firms

Invoice factoring can be very beneficial to services companies. Companies that offer services to commercial businesses cannot usually pledge tangible assets to banks as collateral for a traditional bank loan. This, unfortunately, means service providers are often denied the loans they need or are approved, but with limited funds to supplement their working capital. Invoice factoring companies offer an alternative financing solution that is substantially easier to get approved for.

- Factoring invoices means quick cash: Consulting companies would be able to receive cash for their outstanding invoices right away, instead of waiting 30 to 90 days for an invoice to pay. The invoice factoring process allows businesses to receive funds in as little as 24 hours.

- Invoice Factoring means no need for a bank loan: To get the funding they need, many companies rely on bank loans. Many consulting firms are not eligible for the funding they need to grow. Invoice factoring is possible even for businesses with a bad credit history or who have been around for a very short time.

- Factoring invoices means support services: Charter Capital will collect the unpaid invoices via letter or a phone call if necessary. We will then return the balance to the company we purchased the invoices from, minus a small fee.

Benefits of Selling Accounts Receivable With a Factoring Company

The use of factoring services will allow you to extend generous payment terms to your customers and still obtain cash to accelerate growth and profits, all without having to take out a loan.

Charter Capital factoring allows you to obtain cash to:

-

Add more employees

Add more employees

-

Pay outstanding debt or tax obligations

Pay outstanding debt or tax obligations

-

Beef-up sales efforts

Beef-up sales efforts

-

Finance Acquisitions of other consulting firms

Finance Acquisitions of other consulting firms

-

For meeting operating cash obligations like payroll

For meeting operating cash obligations like payroll

A dedicated account executive and the use of our back-office support for collections and mailing out your invoices sometimes offset the factoring fees or decrease internal overhead and related costs. We are seasoned professionals with decades of industry experience.

Find Out Why People Say Charter Capital is the Best Factoring Company

Is Factoring for Service Providers the Answer For Service Industries?

We Understand Your Cash Flow Issues

Invoice Factoring from Charter Capital can provide the financing for your business needs, grab new opportunities, invest in marketing, meet payroll demands, or simply meet other expenses.

Charter Capital provides steady cash flow with accounts receivable factoring to service and consulting firms. This allows you to focus on your business growth.

Why Service Companies Benefit from Invoice Factoring

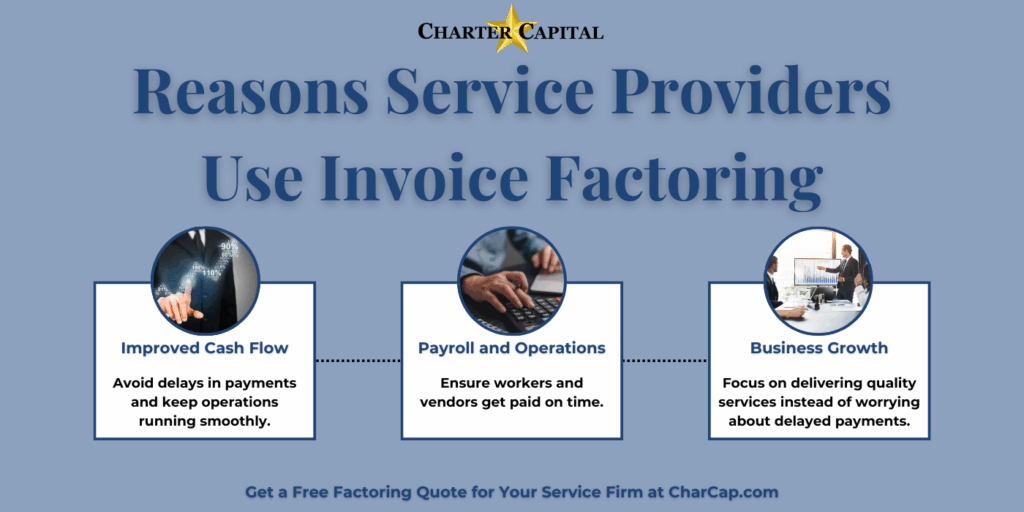

Service companies face unique challenges when it comes to maintaining steady cash flow. Unlike product-based businesses, they often rely on timely payments from clients to meet operational costs. However, client payment delays can create cash flow gaps, making it difficult for service providers to cover critical expenses such as payroll, rent, or marketing investments.

Invoice factoring is a great solution for these challenges. By converting outstanding invoices into immediate cash, service companies can avoid disruptions caused by slow-paying clients. This form of financing is particularly valuable for businesses that lack tangible assets to use as collateral for traditional financing, such as a business loan. With factoring, service companies can secure funding based on the creditworthiness of their clients, rather than their own financial history.

Additionally, invoice factoring helps businesses streamline operations by outsourcing receivable collections. Many factoring companies specialize in non-recourse factoring, which shifts the risk of non-payment from the business to the factoring company. This allows service providers to focus on delivering quality services instead of worrying about delayed payments. By bridging cash flow gaps, invoice factoring enables service companies to remain competitive and pursue growth opportunities with confidence.

How Do Factoring Fees and Rates Work? Understanding the Costs

Invoice factoring allows businesses to sell outstanding invoices to a factoring company at a discount, providing immediate cash flow without taking on debt. However, factoring costs can vary based on several factors, including the creditworthiness of the invoiced customer, the invoice amount, and the type of factoring agreement chosen.

Factoring companies charge a factoring fee, which is a percentage of the invoice value deducted as compensation for their services. The advance rate, or the portion of the invoice paid upfront, typically ranges from 70 to 95 percent. Once the customer pays the invoice, the factoring company releases the remaining balance minus applicable fees.

Invoice factoring rates vary based on whether a business opts for recourse factoring, where the business owner remains responsible if the customer doesn’t pay their invoice, or non-recourse factoring, where the factoring company assumes the risk for an additional cost. Business owners should carefully review the factoring agreement and ask any factoring company they’re considering about hidden fees, contract terms, and how payments to the factoring company are structured to avoid unexpected costs.

The Difference Between Invoice Factoring and Invoice Discounting

While both options provide working capital based on unpaid invoices, invoice factoring and invoice discounting serve different needs and business models. With invoice factoring, a small business transfers control of its receivables to a third party called a factoring company. The factoring company then provides an upfront cash advance, typically a percentage of the invoice face value, and manages collection directly with the customer. Once the invoice is paid, the remaining balance, minus fees, is released to the business. This structure is especially beneficial to small business owners who prefer to outsource collections and receive funds quickly without relying on a line of credit or traditional small business loans.

In contrast, invoice discounting allows a business to maintain control over customer communication. The company borrows against receivables but continues to chase payments in-house. This option suits more established businesses with internal accounting resources and minimal questions about invoice factoring or how factoring companies work.

Knowing the main difference between invoice factoring and discounting helps businesses choose the best financing option. Whether you prefer full-service support or a confidential structure, each type of business financing offers unique advantages depending on your size, goals, and customer relationships.

Solve Your Cash Flow Challenges with Tailored Invoice Factoring for Service Providers

Longer payment windows are the norm in the service industry and are often vital to maintaining strong client relationships and winning new business. But, waiting weeks or months often leaves businesses like yours unable to cover daily expenses and grow. With tailored invoice factoring for service businesses, you can get immediate capital without taking on debt. Plus, with Charter Capital, you can also count on same-day payments and won’t be tied into a long-term contract, so you can tap into funding as needed and focus on your business growth. To explore your options or kickstart the approval process, request a no-obligation funding estimate.