Freight factoring is a financial transaction that provides trucking companies with immediate access to working capital by selling their unpaid invoices to a factoring company. Unlike a loan, factoring involves no debt, making it an ideal solution for trucking companies of all sizes, including owner-operators and small fleets. This process ensures steady cash flow by advancing funds quickly, allowing businesses to cover essential expenses such as fuel, maintenance, and payroll without waiting for customers to pay. With various factoring options available, companies can choose between recourse and non-recourse agreements to best fit their needs. Whether you’re dealing with a broker or shipper, freight factoring can help keep your operations running smoothly, even when clients fail to pay on time. By partnering with a reliable factoring company, trucking businesses can secure growth and stability without the burden of traditional bank loans.

Freight Factoring Addresses Modern Trucking Industry Challenges

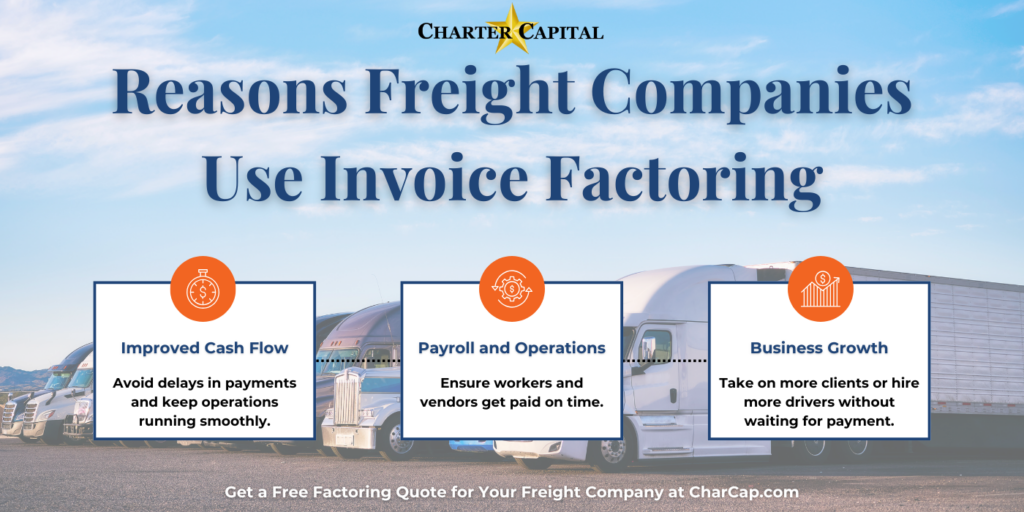

Freight factoring addresses key cash flow challenges in the trucking industry, particularly for businesses dealing with delayed customer payments. By providing immediate access to funds through unpaid invoices, factoring ensures trucking companies—ranging from large fleets to small operators—can cover essential expenses such as fuel, maintenance, and payroll without taking on debt.

For companies navigating fluctuating fuel prices or unexpected repair costs, freight factoring offers a practical solution to maintain steady operations. Many factoring companies for trucking businesses also offer flexible options such as spot factoring and custom factoring agreements, catering to diverse financial needs. The choice between recourse and non-recourse freight factoring further allows businesses to manage risks, ensuring a secure cash flow regardless of client payment reliability.

This financing method eliminates the stress of waiting for customer payments, enabling trucking businesses to focus on growth and long-term stability. Whether you’re an owner-operator or managing a growing fleet, freight factoring provides the financial backbone needed to thrive in today’s competitive trucking industry.

When it Comes to Freight Factoring,

One Star Stands Behind You

- Fast approval process

- Flexible freight factoring terms

- Same-day funding

- Competitive rates

Freight factoring gives you fast, steady access to working capital for:

INSURANCE

Protect your business.

FUEL

The lifeblood of your business.

PAYROLL

Meet payroll obligations and add new drivers

MAINTENANCE

Routine or unexpected repairs.

OPERATIONS

Expand freight operations.

Driving Success: How Martin Pulido Trucking Secured Growth and Stability with Charter Capital

Freight Factoring For Trucking Companies and Freight Brokers

WE MAKE FREIGHT BILL FACTORING SIMPLE

A steady stream of income and positive cash flow is the fuel that keeps your business running. With a freight factoring line from Charter Capital, you have an on-hand solution to obtaining the funds you need to operate and grow your trucking business.

These days, borrowing from an online lender or commercial bank can come with numerous pitfalls. Charter Capital offers an affordable working capital solution and reasonable factoring rates that doesn’t require you to take on additional debt. Our invoice factoring services are fast and keep your business rolling with a flexible funding process that eliminates any roadblocks.

Freight invoice factoring is the selling of business invoices or accounts receivables to a factoring company for trucking, like Charter Capital. This is an effective alternative to waiting for customers to pay their outstanding invoices or applying for a bank loan.

Freight Factoring Essentials for Trucking Business Cash Flow Optimization

Freight factoring, a specialized form of invoice factoring, is revolutionizing cash flow for trucking companies. This financial solution, often referred to as truck factoring, allows freight and trucking companies to sell their outstanding invoices to a factoring company, providing immediate access to working capital. Understanding how freight factoring works is crucial for small trucking businesses and new trucking companies looking to stabilize and grow their operations.

The process of freight invoice factoring involves submitting invoices to a factoring company, which then advances a significant portion of the invoice value, minus the factoring fee. This approach is not a loan but a way to accelerate cash flow, making it ideal for transportation factoring. Companies that use factoring, especially those in the freight and trucking industry, benefit from the quick injection of funds, enabling them to run their trucking business more efficiently.

Qualifying for freight factoring is simpler than traditional financing options. Freight factoring companies typically offer both recourse and non-recourse factoring, giving trucking businesses the flexibility to choose the type of factoring that best suits their needs. Recourse factoring means your trucking company retains the risk if the client doesn’t pay, while non-recourse factoring provides more security, as the factoring company absorbs the cost of the unpaid debt, removing liability from your business.

Factoring for trucking companies is not just about improving cash flow; it’s also about ease and convenience. The best factoring companies for truckers offer services like handling collections and providing support, allowing trucking companies to focus on hauling freight rather than chasing payments. When a trucking company uses freight factoring, the factoring company will pay you nearly the full value of the invoice, providing the financial backbone necessary for growth and stability.

Freight factoring for trucking companies is an effective, efficient way to manage finances. Whether it’s a small trucking firm or a large freight business, factoring provides a reliable method to ensure steady cash flow. With freight factoring, trucking companies can expand their operations and explore new opportunities without the weight of financial constraints. Learn more about freight factoring and discover if it’s the right solution for your trucking business.

Understanding Recourse and Non-Recourse Factoring: Which Option is Best for Your Trucking Business?

When choosing the right freight factoring company, understanding the differences between recourse and non-recourse factoring options is essential. These options have distinct advantages and implications for trucking companies, as they impact both cash flow security and the potential risk your business may face.

Recourse factoring is generally less expensive because it entails some responsibility on the trucking company if the customer fails to pay. With recourse factoring, if a customer’s invoice goes unpaid, your trucking company must take it back and ensure the factoring company does not take a loss on it.

This arrangement works well for trucking companies with dependable clients who pay on time, as it reduces the cost of factoring while providing reliable cash flow. However, it’s essential to assess the factoring agreement carefully to ensure it aligns with your customer payment patterns and risk tolerance.

On the other hand, non-recourse freight factoring offers a more secure option, especially for truck drivers and transportation companies concerned about potential customer payment issues. With true non-recourse factoring, the factoring provider assumes the risk of non-payment if the customer defaults, covering any potential losses themselves. This form of factoring is ideal for smaller fleets and owner-operators who may not have extensive reserves to cover unpaid invoices, making it a smart choice for companies that offer non-recourse factoring as part of their factoring program. While non-recourse arrangements may come with slightly higher fees, the security and peace of mind provided can be invaluable, especially for growing or larger trucking businesses looking to stay stable.

Choosing between recourse and non-recourse depends largely on your company’s size, client reliability, and financial goals. Partnering with a transparent factoring company that provides clear details on both options will ensure you find the best fit for your business. Additionally, some of the top factoring companies for trucking offer customized factoring solutions to address unique business needs, providing a factoring partner who understands the complexities of the industry. Ultimately, selecting the right freight factoring provider can empower your trucking business to stay on top of cash flow, minimize financial risks, and focus on growth.

Hidden Costs to Watch for When Choosing a Factoring Company

Freight factoring provides quick access to capital, but factoring companies also impose fees beyond the standard flat factoring fee, impacting overall costs. Trucking businesses need a factoring company with transparent pricing to avoid unexpected charges.

1. Application and Processing Fees

Some factoring companies charge an application fee before funding begins. These upfront costs add to expenses, especially for small trucking companies. Before committing, businesses should compare factoring rates vary depending on setup costs.

2. Minimum Volume Requirements

Not all factoring for freight providers offer flexibility. Some factoring companies assess penalties if businesses fail to meet a minimum invoice volume. Trucking businesses should look for offer spot factoring to avoid unnecessary fees.

3. Tiered vs. Flat Factoring Rates

Factoring rates vary based on structure. While some providers use flat factoring, others impose tiered factoring, where truck factoring rates change based on volume. Understanding a factoring company’s pricing helps in shopping for invoice factoring wisely.

4. Transfer and Termination Fees

Many providers charge for ACH and wire transfers, which add up over time. Additionally, some contracts include early termination penalties, making it costly to switch providers. Looking for a factoring company with transparent terms prevents financial surprises.

Before choosing a provider, trucking businesses must analyze costs based on the factoring structure. That’s how factoring companies ensure fair agreements without hidden fees.

How Does Truck Factoring Work?

- You continue to bill your customers as you always have.

- You submit the invoices that you want to factor to Charter Capital along with our simple factor form.

- We typically deposit your funds into your bank account on the same day you invoice, minus a small factoring fee.

- We wait for your customer to pay the invoice directly to us When we receive payment, we notify you on the same day.

- You continue to grow your business, free from cash flow worries.

At Charter Capital, each client is assigned one dedicated account manager, making coordination easy. We also provide back-office support for credit and collections and mailing out invoices or other factoring processes.

Benefits of Using a Truck Factoring Company

- Fast access to working capital at low rates for local and regional carriers, long haul carriers, and freight brokers.

- Minimal paperwork, easy application.

- You factor only the invoices you choose.

- Highest advance rates in the industry.

- No term contracts.

- Low rates, no hidden fees.

- Free credit checks.

- Fuel cards available.

- Does not increase your business debt.

- Extend generous payment terms without having to borrow money.

- Reduce bank NSF charges.

- Negotiate supplier discounts.

Types of Freight Companies Using Our Freight Factoring Services

Charter Capital provides freight factoring services for owner-operators in the trucking industry nationwide. Freight factoring provides you with an easily accessible source of funds. Working capital is available without the need for additional debt.

Types of freight companies we serve:

- Owner-Operators

- Small and Mid-Size Trucking Fleets

- Freight Brokers

- Auto Haulers

- Dump Truck Services

- Oilfield Transportation Services

- Hot Shot Trucking

- OTR & Motor Carriers

More Benefits of Freight Factoring for Trucking Companies and Owner-Operators:

- Speedy service and funding within 24 hours once your account is set up

- Immediate cash flow to help operate your business

- Flexibility to structure customized financing

- Flexibility to factor only the invoices you choose

- Minimal paperwork and a user-friendly application

- No hidden fees, no application fee

- No long-term contracts

- Free credit checks

- Fuel cards available

- Highest advance rates in the industry

- Comprehensive reporting

The Extra Mile, Defined.

As a small to medium-sized carrier, you need to have a steady cash flow for your trucking in order to pay for essential expenses like fuel, repairs, payroll, and maintenance that are necessary to keep your business rolling. Many trucking companies use freight factoring in the trucking industry to gain quick access to working capital.

At Charter Capital, Fast Cash at Competitive Rates is Just The Beginning. You also Get:

- Customized financing that fits your needs.

- Transportation specialists who understand your unique business problems and goals.

- A true partner to help you overcome financing hurdles and do the extra work to make factoring work for you.

- Dedicated account managers who care about your business.

- Fast response with no layers of approvals.

We’ve earned a reputation for assisting trucking businesses over the past 30 years. Long-term customer relationships and client referrals illustrate the positive results of your personal, one-on-one service.

How Does Freight Factoring Work? Easy!

Our funding method acts as an alternative source of business financing and eliminates many of the criteria required for traditional bank loans. Your ability to get funding is based on the creditworthiness of your customers, not your balance sheet. The amount of funding you have access to increases in proportion to your invoicing.

Grow Your Trucking Company’s Cash Flow with Transportation Factoring

The key to growing a freight company, or any business for that matter, is working smarter—not harder! Of course, that’s easier said than done. Here are a few ways lean and mean freight companies can make cash owed to them work smarter.

Make Your Money Work

Maintaining positive cash flow is perhaps the most challenging part of managing a fleet with fewer than 100 trucks. A single truck can cause a company to be in financial trouble until it is repaired. This means that there is one less account receivable while an account payable–mechanics’ services–is outbound.

One way to maintain cash flow without hitting the brakes is by using a freight factoring company. A factoring service funds slow-paying freight bills so that fleet operators can keep their feet on the gas pedal. By receiving payments early, operators have money to pay drivers, maintain vehicles, and even expand.

Invoice factoring allows business owners to grow their business without the stress of maintaining cash flow. Fleet operators can’t take their time delivering their goods, so they shouldn’t have to wait for payments once the service is provided.

Here’s how it works: When a driver delivers freight to a customer, you send the bill to the customer and submit a copy to a transportation factoring company like Charter Capital. The factoring company pays you, and you use the funds to grease the wheels of your successful business. Once the freight customer pays the factoring company, the transaction is finished.

Free Fuel Advance for Your Business

Turn your freight bills into SAME-DAY cash!

- Low Rates

- No Term Contracts

- No Hidden Fees

- Free Credit Checks

- Dedicated Account Rep

- Fuel Cards Available

- Free Load Board Access

- And MORE!

So Why Choose Freight Bill Factoring Over a Traditional Bank Loan?

For starters, getting approved to use invoice factoring is a lot easier than getting approved for a bank loan. For small or new freight and trucking companies that haven’t had the opportunity to establish credit, a transportation factoring service can fill the void with limited fees and quick access to cash flow. Invoice factoring approval is based on the credit of a business’s customers—not on the credit of the fleet operator or manager.

Freight factoring avoids debt. Freight factoring companies make a small portion of the amount that you charge your customers. You don’t have to pay interest or carry any debt. Factoring allows you to get paid immediately after providing a service. Instead of waiting for 90 days, the customer will pay.

Using freight factoring for your trucking company’s needs is also a quicker process than getting a bank loan. Some freight factoring companies can issue a direct deposit or wire money on the same day. Banks can take weeks or even months to approve a business loan.

Accelerate the Growth of Your Trucking Company with Freight Factoring

Waiting weeks or months for payment can create strain for any business, but with tucking firms, it can literally stop your wheels from turning. As transportation factoring specialists, we eliminate cash flow gaps and offer tailored perks like fuel cards and load board access to help your business thrive. To find out more or get started, request a no-obligation freight factoring estimate.