How is Invoice Factoring Different From a Commercial Loan?

When comparing a commercial loan vs invoice factoring, businesses often find Charter Capital’s invoice factoring offers faster approval, more flexible terms, and no debt on the balance sheet. Unlike commercial loans that require extensive financial statements, three years of tax records, and strong personal credit, Charter Capital provides same-day funding based on your customers’ creditworthiness, with advances up to 98 percent of invoice value. Our invoice factoring solutions serve fast-growing businesses, startups, seasonal companies, and those facing financial challenges that would be denied traditional bank financing.

Simple: It’s not a loan and does not show up on your balance sheet as debt.

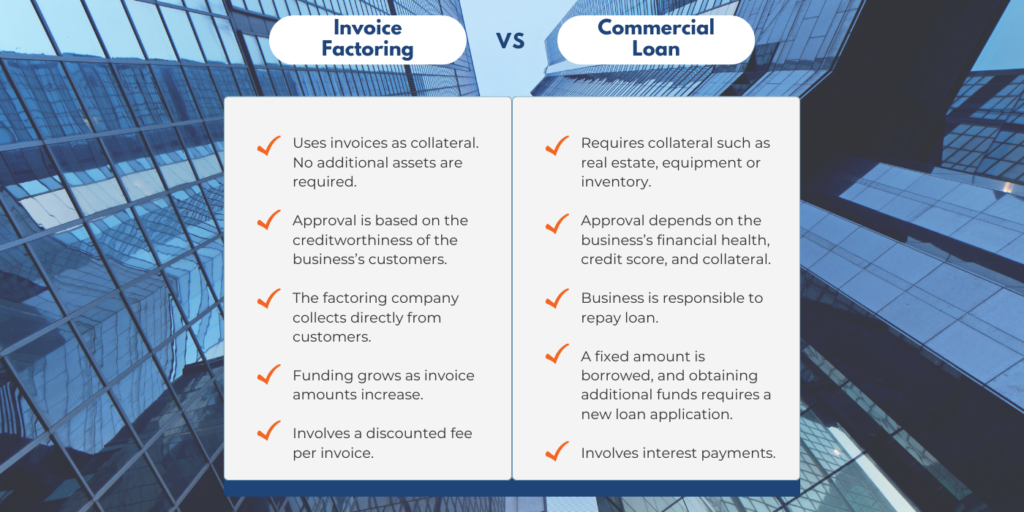

Factoring is a great way to raise immediate cash for any purpose your business may have, from operations to payroll. The effectiveness, speed, and flexibility of factoring have made the process a preferred non-loan alternative to commercial loans. Here are a few notable comparisons:

| Businesses Funded | Invoice Factoring | Commercial Loan |

| Fast Growth | YES | NO |

| Start-ups | YES | NO |

| Profitable with no capital | YES | NO |

| Financial losses | YES | NO |

| Seasonal | YES | NO |

| Program Features | ||

| Unlimited A/R Funding | YES | NO |

| No financial covenants | YES | NO |

| Advances up to 98% | YES | NO |

| Free credit checks | YES | NO |

| A/R management | YES | NO |

| Approval Process | ||

| Financial statements needed | NO | YES |

| Dependent on personal credit | NO | YES |

| Must provide 3 years tax records | NO | YES |

| Lengthy approval process | NO | YES |

| Denied for IRS Problems – Tax liens | NO | YES |

Is Invoice Factoring a type of commercial loan? Absolutely not.

Even though the process of accounts receivable factoring is sometimes referred to as “factoring loans,” it not a loan, but is a financial transaction between the business seeking funds and factoring companies. There is no bank involved. Accounts Receivable Factoring (Invoice Factoring) is when a company, like Charter Capital, purchases your accounts receivable invoices at a discount rate and provides you with immediate cash.

Factoring can be a great alternative to traditional loans. It gives your business access to quick cash flow and is a funding solution that is instant and unlimited. The use of Accounts Receivable Factoring means that your open customer invoices (accounts due) are “cash in the bank.”

Accounts Receivable Factoring Companies are a great alternative to a commercial loan for business funding

As an alternative source of business financing, invoice factoring eliminates many of the difficult-to-meet criteria that companies must face in order to get a commercial loan. If you can get a loan or line of credit in today’s tight banking market, what’s going to happen after you’ve depleted those funds? You will still have to wait for the outstanding invoices to be paid. The biggest problem with a traditional bank loan is that there is a maximum credit limit.

In comparison, Charter Capital provides no-loan cash based on the quality and liquidity of your assets (your accounts receivable). Because each account is evaluated individually, Charter Capital has much more flexibility than a Bank regarding keeping up with an increase in sales. This means that businesses can access a larger amount of working capital than traditional loans to support growth. Charter Capital also offers a much faster approval process and access to funds in as little as 24 to 48 hours.