“The most powerful ingredient in business is positive momentum. Get it and keep it.” Although this powerful quote can’t be attributed to any one person, the sentiment stands. Scaling up a business is challenging. Leveraging the momentum you’ve built makes it easier and opens new opportunities.

But, what does momentum in business look like, and how can you capitalize on momentum to amplify the results you’re getting? Give us a few minutes, and we’ll walk you through these concepts and provide some business growth strategies to get you started.

Recognizing the Right Time to Scale Your Business

- Proven Success: If your business consistently hits its targets and shows stable growth, it’s a sign you’re doing something right.

- Rising Demand: An unmistakable sign is when the demand for your product or service consistently exceeds your current capacity.

- Replicable Processes: When you can standardize and replicate business operations efficiently across different scenarios, you’re ready.

- Financial Health: Examine your balance sheet. If revenues are steadily increasing and you have a buffer to absorb potential scaling challenges, it might be time.

- Skilled Workforce: If you’ve got a team that’s efficient, adaptable, and can handle the challenges of expansion, you’re a step ahead.

- Feedback & Data: Your customers’ feedback and data analytics might be suggesting a shift. If there’s a consistent request for expansion or more offerings, heed the call.

Scaling is a big decision, but recognizing these signs can offer clarity on when it’s the right move.

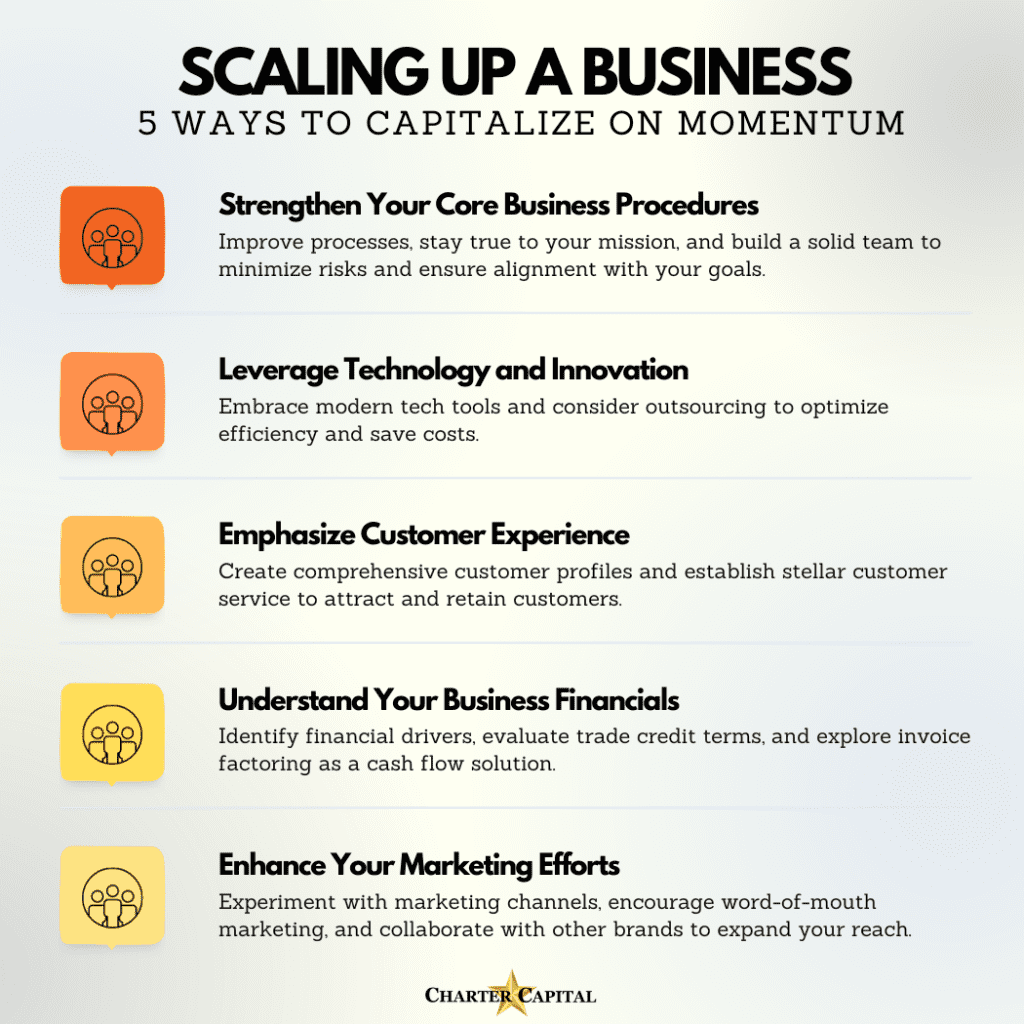

1. Strengthen Your Core Business Procedures

It’s easy to have rose-colored glasses when scaling up a business as if all your problems will evaporate with increased revenue. In reality, your problems will scale with you. Minimize the risk of this by getting the right processes and people in place now.

Remain True to Yourself and Your Mission

We know that authenticity is vital for businesses. Customers are willing to pay more for your products or services when they believe you’re authentic, as HBR reports. It’s essential in building trust and when attracting and retaining customers. It also makes a massive difference in how you and your team feel about the work that you do.

Businesses must make decisions at the speed of light when a high-growth period kicks in, and we don’t always see how we’re slipping away from our core values until we’ve ventured so far off our intended path that we can’t even tell how we arrived there. It may start as compromising on the quality of raw goods to ensure supplies arrive on time or to stretch a budget and ultimately result in a subpar product. Or, maybe it’s a shortcut in your customer service processes that diminishes the customer experience. Consider whether the new process or item aligns with your goals as you face these decisions. Don’t compromise if it doesn’t.

Focus on Building a Solid Team

Have a strategy in place for recruiting a solid team. Identify which roles you’ll need to fill and the criteria you’ll use to determine your readiness to hire beforehand. It may also be helpful to draft your job descriptions now while you have time, though expect to revamp them later as your needs for the role become clearer.

Invest in Your Employees

As you’re hiring, make sure you’re offering competitive wages and bringing employees into an environment where they can do their best work. Because effective team building has been shown to improve teamwork, morale, and more, planning your strategy for this and employee development in advance is a good idea.

2. Leverage Technology and Innovation

Leveraging technology and innovation in business is crucial to success. It can help stretch your dollars when scaling up a business and ensure your money is going where it will have the greatest impact.

Make the Most of Modern Tech Tools

There’s a multitude of online tools that can streamline processes and save your business money. For instance, investing in a project management tool increases the odds of reaching your goals by 21 percent, according to the Project Management Institute. Bookkeeping and accounting tools can make managing your money easier and getting paid faster. You can even boost sales by 29 percent by implementing a customer relationship management (CRM) platform, per HubSpot data.

While there may be upfront costs as you invest in new tech, it usually saves you money in the end through increased efficiency and sales.

Consider Outsourcing Certain Tasks

Outsourcing benefits businesses in lots of ways. For instance, you may outsource your marketing to ensure an expert handles it and that you get maximum ROI. Or, you might outsource customer service to provide customers with a broader range of options and save money. These options also allow you to focus more on the daily aspects of running your business.

One area business owners often overlook when it comes to outsourcing is additional services provided by their current vendors and partners. For example, if you work with an invoice factoring company like Charter Capital, your payments are collected for you. You’ll also qualify for free client credit reports, so making informed decisions about how much credit you extend to your customers is easier.

3. Emphasize Customer Experience

Businesses that focus on customer experience (CX) achieve up to a 15 percent increase in revenue, according to Zippia. Their customers are willing to pay 16 percent more too. Focusing on CX while your business is on the smaller side allows you to replicate great experiences as you grow, so your business scales faster and more solidly.

Create Comprehensive, Updated Customer Profiles

Earlier, we talked about investing in a CRM. This is where it really starts to pay off. A CRM that’s loaded with customer data will help you improve virtually all areas of your business. For instance, you can track their interest in products and services, market to specific groups, track and improve your sales cycle, and more.

Ensure a Stellar Customer Service Setup

Consider the whole customer journey as you set up your customer service processes.

- Onboarding and Training: Ensure customers understand how to use your products or services.

- Self-Service Tools: Provide customers with tools they can access 24/7 to learn more about your offerings or troubleshoot issues, such as video tutorials, user guides, and chatbots.

- Reactive Customer Service: Ensure customers can easily reach you through their preferred channel if they have an issue. Phone, email, social media, and live online chat may all deserve a place in your strategy.

- Proactive Customer Service: Request feedback from your clients and ask how their experience is going. This step is vital because not all dissatisfied customers will complain. Plus, it shows your clients you care, which improves the experience even more.

4. Understand Your Business Financials

Cash is tight when you’re scaling up a business. You have new and increased expenses that you must pay with the money you earned yesterday when your revenue was lower. This is why cash flow issues, not a lack of profit, hurt most growing businesses. Address a few key areas to ensure you have enough cash on hand while you’re scaling.

Know What’s Driving Your Financial Decisions

You’ll need to do some soul-searching or work with an accountant to determine what’s driving your financial decisions and if you’re serving your company’s best interests. One common issue in growing businesses is the tendency to put off uncomfortable truths or difficult situations. For instance, you might know money is tight and have an idea that you may need to do something about it but put it off until you can’t make payroll. This can be a slippery slope because businesses in this situation often have knee-jerk reactions and accept any funding they can get in time, even if it’s costly or damages the business in the long run.

Your financial behavior may be different. Nevertheless, it’s always a good idea to examine how you’re spending, managing, and obtaining funds to see if there are patterns you can improve.

Evaluate Your Trade Credit Terms

Businesses don’t always recognize that they’re extending credit when invoicing clients after goods or services are delivered. However, if you invoice, that’s precisely what you’re doing. Unfortunately, businesses sometimes take advantage of this system by paying late or not paying until right before the due date. A growing business cannot withstand this kind of strain for long. Reevaluate your payment terms to see if you can accelerate payments by shortening the payment window, adding late fees, or leveraging other tactics.

Explore Invoice Factoring as a Cash Flow Solution

If you can’t adjust your trade credit terms or doing so isn’t enough, invoice factoring may be your ideal cash flow solution. Instead of relying on your clients to pay faster, you’ll sell your invoices to a factoring company like Charter Capital at a discount. You’ll receive most of the invoice’s value upfront and can spend the cash in whatever way makes the most sense for your business. Then, you’ll receive the remaining value of the invoice, minus a small factoring fee, when your client pays their invoice.

This approach works particularly well for growing businesses because it’s not a loan. Therefore, you’re not subject to the same rigid qualifications. Most businesses are approved. It also doesn’t result in debt that your business must pay off like a loan does. Plus, you can set factoring up in advance and not use it until needed. It helps eliminate knee-jerk financial decisions because of this.

5. Enhance Your Marketing Efforts

It may seem odd to double down on marketing efforts when business is going strong, but this is the perfect time. You have something happening right now. Maybe demand increased, a competitor shut down, or some other condition changed that is accelerating your business growth. Most of these situations also mean that any marketing initiatives you kick off now will be more effective than usual and allow you to capture an even greater slice of the market.

Experiment More in Marketing and Advertising

Try funneling some of the additional revenue into marketing and advertising channels you haven’t tried yet or leveraging a new approach to channels you’ve had lackluster results with in the past.

Encourage Your Customers to Do Your Marketing

Word-of-mouth marketing is one of the most powerful forms of marketing. Your influx of business means you have a whole new group of people who can help spread the word. On a basic level, you can increase word-of-mouth marketing simply by asking customers to leave reviews for your business online. Then, build a formal referral program. These programs incentivize customers to refer their friends, family, and associates to your company. Some brands offer customers a discount or free item for each referral, while others pay cash rewards.

Collaborate with Another Brand for Mutual Benefits

A referral partner program works similarly to a customer referral program. In this case, however, it’s usually other businesses or professionals sending referrals rather than your clients. It’s a very effective way to get more leads or sales and can easily be launched at the same time you begin your referral program for customers.

The more you network with other brands, the more you’ll likely find comarketing opportunities. For instance, you may be able to work with a brand that shares your audience on webinars, research publications, podcasts, or blogs.

Successfully Scale Your Business With the Help of Charter Capital

If you’re struggling to bridge cash flow gaps during rapid growth or want to kick off some of the initiatives covered here but lack the working capital, invoice factoring from Charter Capital can help. To learn more or get started, request a free rate quote.

- How to Use ChatGPT for Answers, Inspiration & Productivity - April 14, 2025

- How Factoring Supports Business Continuity Plans - March 17, 2025

- Factoring vs. Supply Chain Financing: Which is Right for You? - February 17, 2025